The USD moved higher in trading today as the market prepares for the Fed decision on Wednesday. The BOE and ECB will also meet this week (decisions are on Thursday).

The Fed is expected to raise rates by 25 basis points when the decision is released on Wednesday at 2 PM ET. That would take the ceiling rate to 4.75% from 4.5% currently. The Fed officials have been lobbying for a terminal rate 5% to 5.25%. Fed’s Bullard, not a voting member, has lobbied for getting to the terminal rate faster, but most Fed officials before the start of the blackout period, have felt 25 basis points was appropriate.

The BOE and the ECB are expected to increase by 50 bps each. The ECB rise would take the rate to 3% from 2.5%. The Bank of England move would see the target go from 3.5% to 4.0%

Also this week is the US employment report which will be released on Friday with expectations of 190K vs 223K last month. Big week for central banks and data. Oh… the likes of Amazon, Apple, Alphabet, Merck, Bristol Myers Squibb, Ford, GM, Starbucks and Meta are all announcing earnings as well. Buckle up traders.

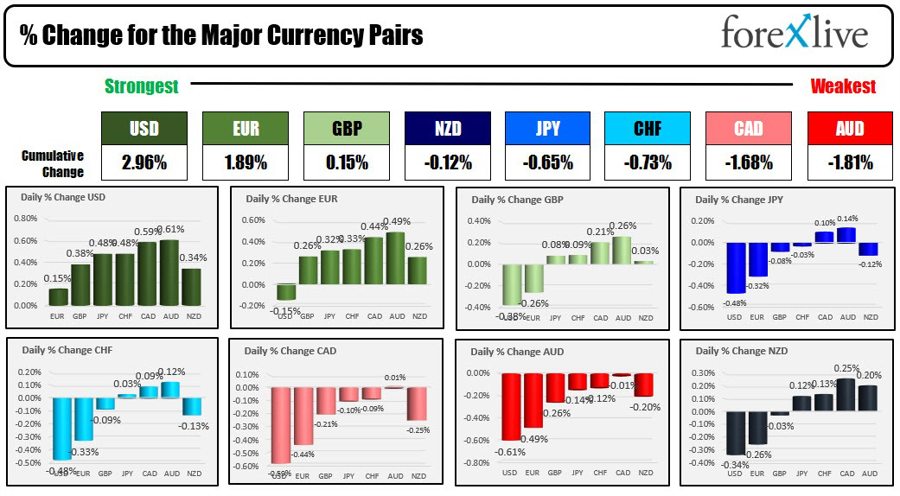

Looking at the strongest to the weakest today, the USD was the strongest, while the AUD is the weakest. The AUDUSD moved the most, falling by 0.61% as the pair reacted to some risk off sentiment and declines in commodities. Gold fell around $5 on the day. Crude oil was down about $2 on the day.

Ths strongest to the weakest of the major currencies

IN the US stock market, the week got off to a negative start with all the major indices moving to the downside:

- Dow industrial average fell -0.77%

- S&P index fell -1.30%

- Nasdaq index fell -1.96%

- Russell 2000 fell -1.35%

In the US debt market, yields moved higher to start the week”

- 2 year 4.234%, +3.1 bps

- 5 year 3.662%, +4.8 bps

- 10 year 3.542%, +3.2 bps

- 30 year 3.652% +3.0 bps

In other markets:

- Spot gold fell -$4.60 or -0.24% to $1922.70

- SPot silver rose $0.02 or 0.09% at $23.59

- Crude oil fell -$1.93 or -2.42% at $77.75

- Bitcoin closed lower at $22746 on the day